NPCI Sets Deadline to Deactivate Inactive UPI IDs:

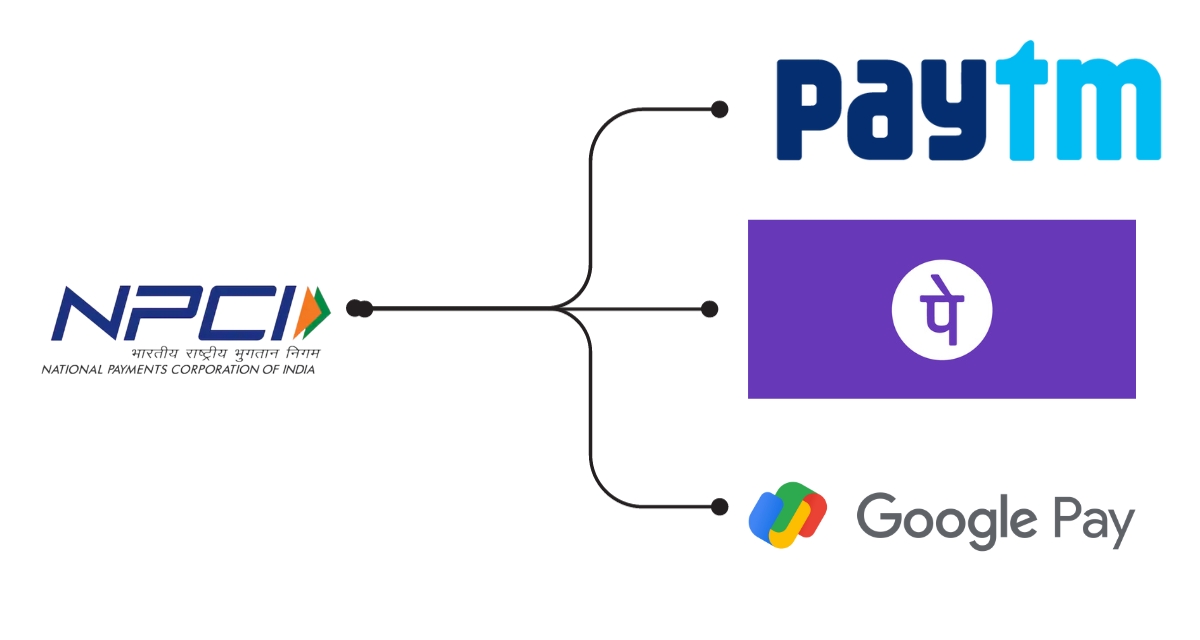

In a significant move to enhance the security and efficiency of digital payments, the National Payments Corporation of India (NPCI) has issued new guidelines instructing payment apps like Google Pay, PhonePe, and Paytm to deactivate inactive UPI IDs by December 31, 2023. This directive aims to streamline the usage of UPI IDs, ensuring that only actively utilized ones remain operational. Here’s everything you need to know:

1. The Purpose Behind Deactivation

The primary goal of this directive is to prevent inadvertent fund transfers to unintended recipients and safeguard the interests of UPI users. It is crucial for customers to regularly review and verify their information within the banking system to ensure a safe and secure transactional experience. Often, customers change their mobile numbers without disassociating their previous numbers from the banking system, creating potential security risks.

Mehul Mistry, Global Head of Strategy at Wibmo, a PayU firm, emphasized that these guidelines are aimed at enhancing security, reliability, and overall customer experience in the world of digital payments.

2. What the Guidelines Encompass

The NPCI’s guidelines outline several key measures:

- Identification of Inactive UPI IDs: All Third Party Application Providers (TPAPs) and Payment Service Provider (PSP) banks are required to identify UPI IDs and associated UPI numbers and phone numbers of customers who have not performed any financial (debit or credit) or non-financial transactions for a period of one year from UPI Apps.

- Deactivation of Inactive UPI IDs: UPI IDs and UPI numbers of such customers shall be disabled for inward credit transactions.

- Phone Number Deregistration: PSPs are instructed to deregister the same phone number from the UPI mapper as well. Customers with inward credit block UPI IDs and phone numbers shall re-register in their respective UPI apps for UPI mapper linkage. This ensures that they can continue making payments and non-financial transactions using their UPI Pin.

- Enhanced Requester Validation: UPI apps are required to perform Requester Validation (ReqValAd) before initiating ‘pay-to-contact’ or ‘pay to mobile number’ transactions. This ensures that customers can verify the recipient’s name before proceeding with the transaction.

3. Implementation Deadline

All UPI Apps, including TPAPs and PSP banks, must implement these guidelines by December 31, 2023. It is essential for users to be aware of these changes and take appropriate actions to ensure their UPI IDs remain active.

In conclusion, NPCI’s move to deactivate inactive UPI IDs is a proactive step towards bolstering security and efficiency in digital payments. Users are encouraged to review their UPI accounts and make necessary updates to avoid any disruptions in their transactional experience. By adhering to these guidelines, both customers and service providers can contribute to a safer and more reliable digital payments ecosystem.